In September 2016, the state Supreme Court ruled that the Pennsylvania local share assessment tax was unconstitutional and lawmakers were given a January deadline to find a solution. By the January deadline, lawmakers had yet to come up with a way to solve the tax issue. Another deadline was given, this time May 26th. Lawmakers have still not provided a solution, so one representative has plans to introduce a stand-alone bill in efforts to amend the gambling law before the May deadline.

A representative of Erie County’s east side, Patrick Harkins does not want to take any chances when it comes to losing the local share assessment payment. $11 million is at stake for the county, money that the area cannot stand to lose. According to The Record Herald, the revenue is crucial to Erie County as they rely on the funds for services as well as economic development projects and community programs. The county is provided around $11 million each year from the Presque Isle Downs & Casino located in the 7BALL CC Summit Township.

The gaming law was implemented in 2004 and mandated that host areas receive 2% of the gross slot machine revenues annually or a $10 million fee, whichever amount was larger. Mount Airy Casino had filed a lawsuit arguing that the assessment was in violation of the state constitution as it placed a heavier tax burden on the casinos that were low performers. The state Supreme Court agreed, with a decision that the assessment tax was unconstitutional as the 12 casinos of the state were not being treated equally.

With the new bill being introduced by Harkins, casinos in Category 1 and Category 2 would pay a flat fee of $10 million. As far as Erie County is concerned, the gaming funds would be divided between the government of the county and the Erie County Gaming Revenue Authority, with Summit Township receiving a share and the City of Erie added as well to receive funds.

The city of Erie would be given $100,000 of slot money that was allocated for the county plus 10% of table gaming revenue that has been allocated to the Gaming Revenue Authority. The City Council decided to approve a resolution earlier in the year to ask lawmakers of the state to be in support of this arrangement. The Council ruled that the money would be shared with the Erie School District as well. Harkins also included Lebanon County in the funds allocation as they share a casino with Dauphin County but do not receive gaming revenues.

It is believed that lawmakers have been focusing their efforts on creating an omnibus piece of legislation that would expand gambling in the state, including a fix for the local share tax. However, Harkins wants to put a stand-alone bill in place just in case lawmakers are unable to agree on other proposals. It seems the omnibus approach has led to disagreements, with some lawmakers not in favor of key points including online gambling and video gaming terminal additions to the state.

According to the Representative, state senators are getting legislation together in regards to gaming with the House having sent HB 271 to the state that would authorize airport gaming among other issues involving gaming. The Senate would then have the ability to amend the bill and include a local share assessment fix.

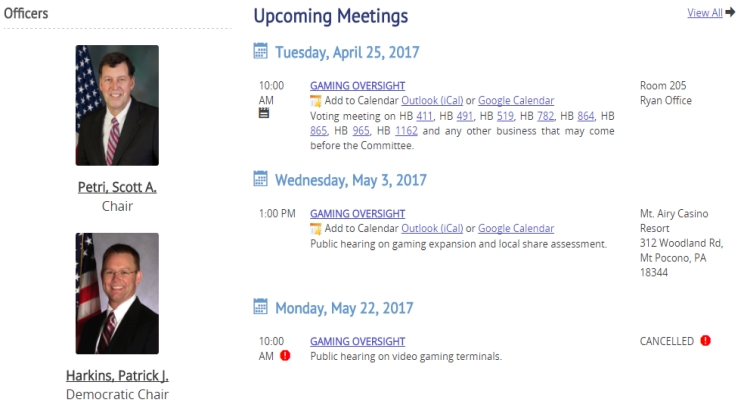

Harkins said that nothing is set in stone but he does expect the Senate to have something sent back to the House in the next few weeks. Any bill sent back to the House would be reviewed by the House Gaming Oversight Committee and Harkins holds the role as minority chairman of this committee.

The committee has been working hard to gather feedback from local officials, including those in Erie, in order to find out how casino money benefits each area. A hearing took place in Erie in March and more hearings are set to take place throughout the state over the next few weeks.